Services

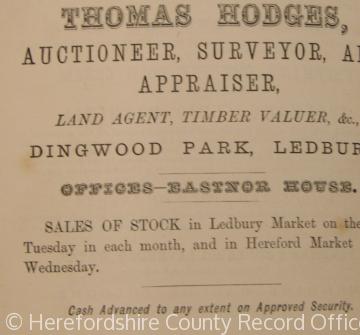

Advertisement for Thomas Hodges, auctioneer, Littlebury's Directory, 1876

Advertisement for Thomas Hodges, auctioneer, Littlebury's Directory, 1876The services which oil the wheels of commerce and civil society have largely, with the exception of the law, developed over the last three or four hundred years. Banking and financial services facilitate the movement of money, for individuals, for investors and for governments. Goods and buildings, even health and lives, can be insured against any number of accidents and mishaps. A wide array of professions, from accountants to surveyors, has developed skills and codes of practice. All are regulated to a greater or lesser degree by legislation. The role of the lawyer obtrudes into all aspects of life, personal, public and commercial.

Banking in England developed in the 17th century. Goldsmiths, especially in London, accepted deposits of money on behalf of clients, having the means to keep it safe, and the value in their own stock-in-trade, gold, to cover its potential loss. They regularly paid bills of exchange, an order to pay on behalf of the drawer to a third party, the payee - the precursor of the modern cheque . By the later 17th century there were a number of private banks and in 1694 the Bank of England was established by Act of Parliament. From 1708 until 1828 this had a near monopoly on the issue of bank notes. During the 18th century a great number of provincial banks were established, many of them founded by Dissenters and Quakers, barred by legislation from other professions. Many of these were short lived enterprises, merging, failing and reforming regularly. During 1825-6 there was a major crisis in banking leading to frequent failures, taking many enterprises down with them. Legislation in 1828 regulated the banking system and once again permitted provincial banks to issue bank notes. This facility was finally stopped for new banks by the Bank Charter Act 1844. The later 19th century saw increasing numbers of mergers and take-overs amongst the provincial banks, so that by the end of the century there had emerged a handful of national joint –stock companies (including the Midland, Barclays, Lloyds, National Provincial and Westminster banks) with only a few private banks still operating, serving a small but select clientele (for example, Coutts and Martins banks). This concentration of banking services in ever fewer corporate hands continued throughout the 20th century.

Building societies, by contrast, developed in the later 18th century, first in the north and midlands of England, and at a lower social stratum than the early banks. The very earliest building societies were small affairs of perhaps 20 – 50 people who clubbed together to pool resources to build modest houses. As each house was completed it was allotted to a member by ballot. Many of these early societies were wound up once all the members had been housed. Some societies went on not to build houses themselves, but to receive savings on deposit and then to lend money on mortgage, enabling many lower-middle class people and artisans to purchase existing houses. Even in the last decade of the 19th century, though, home ownership was unusual. The buildings societies flourished in the 1930s as England experienced a housing boom. At first regulated under the Friendly Society acts and from 1836 under more specific legislation, the records of these societies can shed much light on the development of our towns and the people who built them.

Buying a house is the largest investment most people make and insuring it against fire and other damage is now a major industry. However, it was in the world of shipping that insurance first developed in the 17th century. Merchants meeting at Lloyds Coffee House in London undertook to insure others against loss, and from that developed the Lloyds marine insurance business. The insurance of houses and commercial premises against fire developed in the 18th century and to this day many 18th and 19th century buildings sport the badges of the insurance companies, part identifier of those who had paid the premium and part advertisement. Many of the companies even employed their own fire brigades. The 19th century saw the development of life insurance. Increasingly sophisticated actuarial practices were developed as many friendly societies foundered because of over-generous payment schemes. As the mutual friendly societies declined, so commercial insurance companies grew, providing death benefits in lieu of the old burial payments, and offering insurance against unemployment and ill-health.